Audits are standard practice for the Internal Revenue Service (IRS). The IRS chooses audits based on statistical formulas that analyze tax returns. Businesses must learn how to prepare for a good tax audit. Having your financial records audited can be a stressful experience. But, planning and preparation can help ensure a smooth and successful audit. While the likelihood of an audit is low, they do occur. This article outlines some of the triggers that increase the likelihood of an audit. It also advises on how to handle an IRS audit if one occurs.

Audit preparation: IRS audit triggers

The reality is that an IRS audit of your company is unlikely. Yet, Certain actions can increase the impact of an audit. These red flags include the following:

- Using round numbers

- Failure to report salaries paid to corporate employees

- High deductions for meals and entertainment

- High deductions for the Home Office.

- Using your vehicle only for business.

- For several years, claiming business losses.

- Reporting Higher Income – You should not avoid this. Remember that reporting more business income generally increases the chances of an audit.

Remember that this is not a complete list of every red flag for the IRS. Furthermore, these actions do not imply that an audit is unavoidable. The audit selection procedure includes analytical formulas and comparison procedures. Keep yourself informed about the actions that can lead to receiving an IRS notification.

How do audits function?

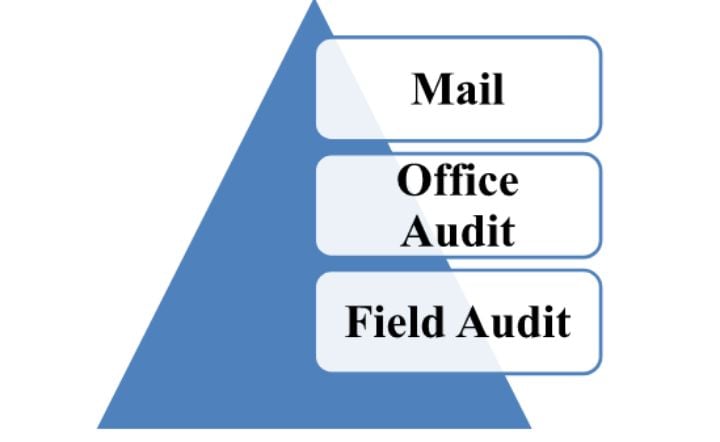

We should start maintaining and researching essential aspects if you want everything in place. IRS conducts the audit in three ways:

Mail – Mail audits ask for more information about tax return items. These are income, expenses, and itemized deductions. Only the things listed in the IRS audit letter are subject to these audits.

Office audit – You’ll have to answer detailed questions about your company’s finances. Also, you’ll need to provide documentation. Office and field audits occur when the auditor wants to examine more records.

Field audit– It takes place at your place of business, your home, or your accountant’s office. Field audits account for most IRS audits. If the audit occurs at your business, you must provide the auditor with a work location on-site. This area should not be visible to customers or employees. You should have an enrolled agent or other tax professionals for office and field audits.

How to Prepare for an audit? Ways to follow:

In an audit, many things are important, like payroll and expense management. However, use software and tools like a paystub generator to keep all the tracks intact. If you want to prepare for the audit, then you must take the following steps:

Plan of time:

The most crucial step in preparing for your audit is planning on time. As the audit approaches, you’ll need more time and resources. The entire finance team must ensure they have the necessary resources and time. This is an essential component of making the process as stress-free as possible. However, year-end audits are only required once a year. Maintain as many records and schedules as possible. It will help you reduce the time required for each yearly audit.

Collect all documents in one location:

Your auditor will provide you with a list of necessary documents for the audit. Begin collecting digital and paper copies of these documents in one place. Also, you’ll need corporate and organizational records. You’ll need meeting minutes, insurance policies, and company agreements. Digital copies of documents are often more convenient for auditors to work with. Create a single digital folder for audit documents and organize everything within it. You can arrange them according to the categories used by the auditor.

Seek the advice of a tax professional:

When receiving an IRS audit notification, consult a licensed tax professional first. You should seek the services of an enrolled agent, a certified public accountant (CPA), or an attorney. Professionals with these specific qualifications may represent you before the IRS. Even if you prefer to handle things on your own, it is strongly advised that you consult with a tax professional. A simple letter from the IRS requesting specific documentation can predict potential problems. It is best to go over the request and other IRS correspondence. You must do it with someone who can assist you in crafting a response.

Learn from previous mistakes:

Audits are rarely completely trouble-free. Most year-end audits will include adjustments. Schedule a planning meeting with audit participants and decision-makers to avoid previous mistakes. It will improve the accuracy of the coming year’s audit. Look over previous audit reports and test the areas where problems have emerged. Resolve those issues or, if needed, work on them. Write a summary of your response to the previous year’s audit. It should include what you did to address the issues raised by the auditor. If a problem is ongoing, notify the auditor immediately, so they know you’re working on a solution.

Make a timetable:

Auditors will request specific evidence of your year-end audit by certain deadlines. You must be clear on when these are and what you must have accomplished as an organization. It will ensure you can supply the necessary documents on time. Make sure you leave enough time for things to go wrong. Furthermore, it is always a good idea to hold regular team meetings. Make sure that everyone is aware of where individuals are with their tasks. This helps reduce the time lost if any staff member is absent during the audit.

Review accounting standards:

Accounting standards are changing. It may have an impact on your organization and its year-end audit. Familiarize yourself with any accounting advancement that may affect how you track data. Maintaining awareness of any new industry standards will make the auditing process easier. It will also assist in identifying areas where you may need more help. It’s crucial to maintain a solid understanding to protect your business. Standards call for specific training for the professionals. This can also emphasize the importance of attending industry conferences. It can be an effective way of staying current.

Conclusion:

Every year, many institutions prepare for an independent audit of their financial records. The prospect of an audit can be challenging and stressful. Proper planning can make the process more manageable. Review your books before the audit. It will help you to identify and resolve issues before the auditor arrives.

We hope you found this blog post on How to prepare for a tax audit? Ways to follow, useful. Be sure to check out our post on Looking to Buy a Home? Effective Strategies to Save Time and Money for more great tips!

Have Experience in the Moving Industry? Want an Additional Income Stream? Work With All Around Moving!

All Around Moving’s program, Work With Us, gives the experienced moving consultants with a unique option to run their own Relocation Consultant business from any city they can operate by.

A nominal one-time start-up fee of $275.00, gives you the “key” to have your business up and running at no time. There is $125.00 monthly recurring expense, and the cost of purchasing your own type of leads you want to work on, such local long distance, international, etc.. We share profits 50-50 with you from all the jobs you book with us. Click here to learn more.