Everyday people start their journey of researching home ownership. Here are 10 Tips For Buying A New Home:

It doesn’t matter what type of buyer you are, buying a house is the most important financial decision most people will ever make. There are many aspects of this decision that you will need to navigate. Whether it is selecting the right location, securing the best price, or ensuring the home is free of any nasty hidden issues.

Buying a House

Even for those who have been through the process before, it can be quite a daunting experience, not to mention if you are a first home buyer.

With the right guidance and research, you can simplify the process and make your journey less stressful.

Here are ten tips to help get you started.

1. Loan Deposits

An essential starting point on the home-buying journey is to understand your financial position and work towards putting yourself in the best financial situation before purchasing a home. This starts with saving for a deposit. How much you need to save will vary given your situation, but the more you have, the better you will look in the eyes of the lenders.

Most people will typically aim to have at least 10% to 20%. If you are unsure what you will require, contact a local mortgage broker or financial advisor.

2. Get in the habit of budgeting well

Once you commit to homeownership, your responsibilities increase. It is best to ensure you build up positive money management habits as soon as possible. The secret to successful budgeting is simple to be realistic. Try to avoid setting overly ambitious goals which you will never meet. Set goals that are achievable and slowly improve over time.

Keep in mind any plans as well – for example, are you planning to start a family, take regular holidays, or maybe you have a balloon payment for your car loan in a year. These will help you get a better grip on your ability to pay a mortgage for years to come.

3. Shortlist suburbs based on your budget

When you know your borrowing limits, start shortlisting suburbs where the median price of houses match your budget. Find a balance between the ‘nice to haves’ and ‘must-haves.’

Look at past sales records and bank estimates of properties matching your needs to help you understand the value of properties in each suburb.

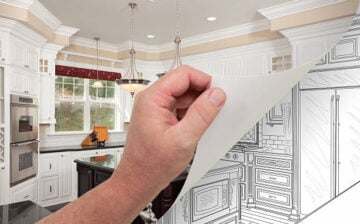

4. The perfect floor plan design

Every family is different, and every house has different qualities. An excellent starting point is to write a checklist of everything you want to find in a new home. Ask yourself some of the following questions:

-

- Do you want a house or an apartment?

- Are you open to building a new home?

- Double or single storey

- How many bedrooms/bathrooms?

- Plot size – is it important?

- Do you want a floor plan with an open plan?

- Do you have any special requirements? Pools/Garden Sheds/Workshops etc

Once you have made your list, prioritize each item from most important to least important. By doing this, you will make the process of navigating the purchase with a significant other much easier; you will know the deal-breakers and be on the same page.

5. Visit, visit, visit

Once you have completed your research online, it’s time to get out there and visit everything on your shortlist. For your shortlisted suburbs, go for a walk, take the train, visit the convenience stores at different times of the day. It will help you gauge the suburb and its overall vibe.

For your shortlisted properties, talk to the real estate agents, go to open house visits (even for properties you are unsure about) if possible, have a chat with the current owners, and gain their feedback – what was it they liked and disliked.

Also, do not forget to establish a great connection with the agents – engage them regularly to check for updates, let them know your likes and dislikes. If they know you are serious, they will do their best to help you reach your desired outcome.

6. Stay sharp while inspecting

Smart sellers and agents naturally spruce up their properties for inspection. You will need to look carefully to understand the true nature of aa property when you are inspecting. Look out for cracks in the architecture, check the age of the building, ask for the last time repairs were made and of what nature, ask how old the appliances are, and yes, look out for even the smallest aspects such as the plug point numbers, leaky taps, etc.

7. Have a firm budget and be flexible with the outcome

Once you have you have finally found your dream home, you will need to either participate in an auction or make an offer. Understand that in some areas, it can be extremely competitive. That’s why it’s best to have some room to move when negotiating or competing against another purchaser.

If you have a strict budget, stay firm, and be open to missing out. To avoid any future stress, it’s essential particularly for first home buyers than you do not overextend – remember, you can always upgrade your home in the future.

8. Improve your credit rating before applying for a loan

Credit rating agencies rate every customer based on their past loans, repayments, bad debts, bills, and outstanding credit card dues. It is always advisable to understand your credit score (you can always order one for a minimal fee) and, where possible, improve it – ensure you have paid out your outstanding dues.

Also, check your existing liabilities and downsize them, where possible. Extra credit cards, pay-later options, outstanding bills – go through them all and pay them out.

9. Get pre-approval

Most banks are happy to assess your financial position and pre-approve a loan, subject to a few months. You may not be looking to buy a property immediately, but it is an excellent practice to get these pre-approved loan estimates from several financial institutions.

By gaining a pre-approval, it will help you to understand and reinforce your borrowing potential as you go around looking for your dream property.

10. Consult experts

When scouting for properties, get in touch with the experts – brokers, conveyancers, solicitors, and real estate agents to ensure you know the process and what is expected of you when you pick a property. Remember, you may stumble across your dream house on any day.

It always helps to know the experts who will need to step in once you formally start the acquisition process, and more importantly, what is the process itself and what are its typical timeframes.

Whether it be the eager young couple looking to buy their first apartment in NYC, the retirees who have decided to research and build a new home in Australia, or even the family in need of extra space due to a new addition to their family. Buying a house is no simple feat, even if you have done it all before!

It’s important you are always well prepared, have done considerable research and take our tips into consideration. It will make your buying journey a more enjoyable experience. Happy house hunting!

Finding Help with Moving Professionals

We hope you found this blog on Tips For Buying A New Home, useful. Check out 5 Mortgage and Finance Tips for First-Time Home Buyers for more helpful tips.

Need to Move Furniture? With All Around Moving you don’t need to worry about any unexpected charges. We are always upfront about our prices. We take pride in taking care of every need of our customers before and during the move. For a stress-free move where you don’t need to take care of anything contact us today! We are “A+” rated members of the Better Business Bureau and a member of Greater New York Chamber of Commerce & Miami Dade

Discover how uniquely priced we are compared to other moving companies in New York, NY & Miami, Florida. Get a moving quote specifically tailored to your moving needs.

Call us TODAY!

Have Experience in the Moving Industry? Want an Additional Income Stream? Work With All Around Moving!

Start an income stream by partnering with All Around Moving Services. Join our team today to start earning. Click here to learn more.