Spotting prime real estate is an essential skill for any real estate investor looking to succeed in house flipping. After all, how do you turn a profit consistently if you don’t have an eye for which houses are going to perform well? Identifying high-potential properties to flip is a combination of careful observation and critical strategies that help seasoned investors differentiate between a money pit and a promising renovation project. Continue reading below as we discuss on how you can apply these methods on your next flipping project.

Qualities of a Good Property to Flip

Location

Location is king in real estate, and it is a crucial factor that determines the success of a house flip. Most buyers can compromise on specifics such as the number of bathrooms, type of flooring, or paint color, but they hardly do on location. As a result, it’s no surprise that houses in high-demand neighborhoods tend to do better. Aside from attracting a wider pool of buyers, they spend fewer days on the market, which translates to fewer holding fees for the investors. When you’re looking for a potential flip, opt for properties that are close to desirable amenities such as public transportation, good schools, restaurants, gyms, and commercial hubs.

Structural Sound

Examine the structural integrity before signing the deed for your next house flip. Some investors find themselves in a tricky situation because they underestimated how much work it would take to turn a fixer-upper that they brought into a habitable accommodation. If structures such as your roof, wall, and foundation are sound, you don’t have to break the bank during the renovation process.

However, if a potential project needs major work done, such as complete house rewiring, that significantly increases your risk and could swallow up some of your profit. Try to find properties with minor renovations rather than those with structural problems.

Good Interior Layout

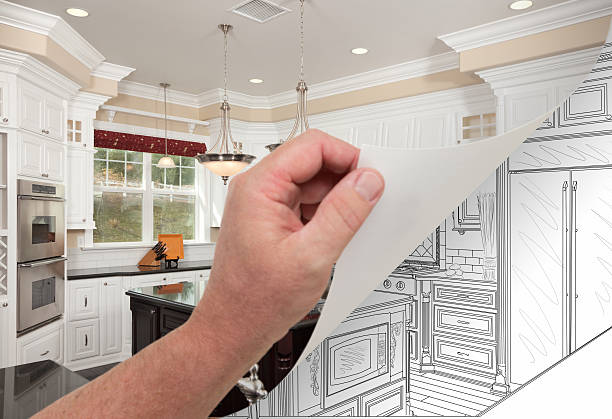

While we’re on the topic of sound structure, you should also prioritize homes with a good interior layout. It’s not uncommon for house flips to require extensions like making the kitchen bigger or adding an extra bedroom. However, if the original plan has the toilet opening up to the kitchen or requires everyone to pass through someone’s bedroom to get into the living room, you’re going to have your work cut out for you. Skip the hassle of dedicating a significant portion of your budget to demolition and rebuilding the property, and choose the ones that have a good sense of structure and proportion to minimize expenses.

Can Be Easily Modernized

Another feature that makes a home ideal for a house flip is that it’s easy to modernize. After all, the idea behind most flips is that you take a dated house and update it with some cosmetic changes into something more appealing. Consult with an experienced hard money lender in Maryland for insights on how property flipping can be a profitable investment venture.

Thus, the older the house, the more money you’ll require to modernize it. For example, lead painting was banned in the late 70s, so houses that were built before then have a high risk of harboring this toxic element. An investor looking to flip one of these houses has to budget for a professional to remove the lead-based paint before adding a new coat. On top of that, you’d also have to replace fittings such as doors, windows, and countertops to make it fit for a family in 2025. In comparison, a house built in 2018 would be far cheaper and easier to modernize.

Why Property Selection is a Great Foundation for a Flipping Project?

-

Minimize Financial Risk

Any strategy you use for your house flips will emphasize two things: keeping your spending to a minimum and maximizing your resale value. Thus, a good property should be able to help you with at least one aspect. For example, a house in a desirable location may be more expensive, but the resale value would be higher. Also, opting for a home with a sound structure reduces your renovation costs and minimizes your risk.

-

Reduce Project Timeline

Most house flips are funded by hard money loans, which are short-term financial solutions. Most investors are under pressure to complete a flip and turn a profit in the least amount of time possible, sometimes as quickly as 6 months. High-potential properties require less time to flip or spend fewer days on the market, allowing you to meet your financial deadlines with greater ease.

Conclusion

Choosing the right home is the single most influential thing you can do to up your chances of success at a house flip. Choose properties in desirable locations to increase your buyer base when the project is complete. Also, save yourself the financial burden of a major renovation by opting for houses with a sound structure and a good layout for a quick turnaround. In the long run, this checklist will minimize your financial exposure and reduce your project timeline.

We hope you found this blog post on Identifying High-Potential Properties to Flip, useful. Be sure to check out our post Things to Know Before Investing In Real Estate For The First Time for more great tips!

Have Experience in the Moving Industry? Want an Additional Income Stream? Work With All Around Moving!

Partner with us, All Around Moving and we’ll help you make money. Click here to learn more.

Blog post submissions are now welcome on our well-established moving blog. Real estate companies, agents, brokers, and agencies are encouraged to contribute their expertise.