Has it always been your dream to own a condo or a house overseas?

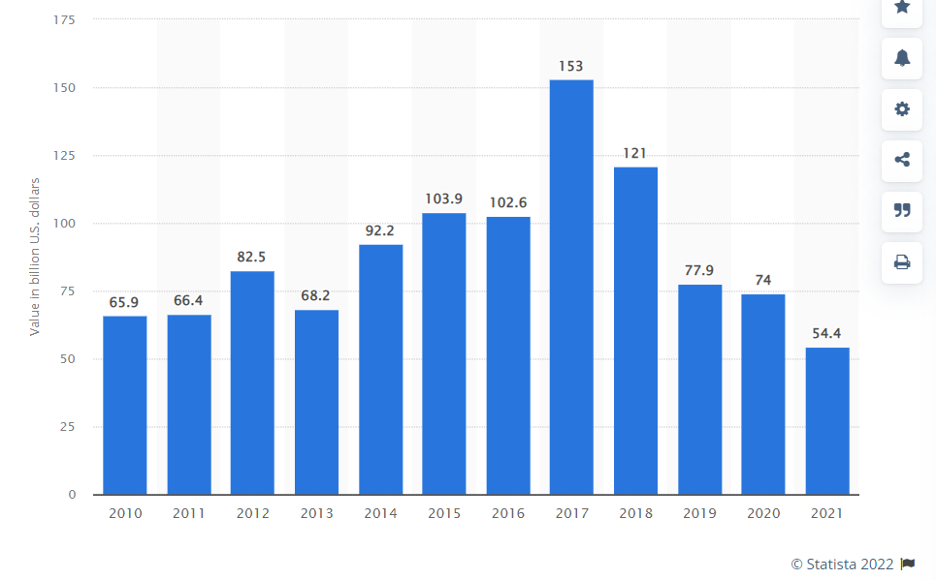

Well, if you’re planning to invest in real estate in the near future, be ready to face fierce competition – the total property sales in the U.S. to foreign buyers in 2021 were estimated to reach $54.4 billion. This number is lower than in the previous years due to the pandemic but still reflects the popularity of foreign investments in the U.S. property:

So, if you want to get ahead of all other buyers, it’s important to calculate every move that will lead you to become an owner of real estate abroad. Surely, the whole process is a bit complicated, but we’ve collected all the necessary tips and advice to speed it up for you.

Let’s dive in.

1. Study Local Real Estate Laws and Regulations

There is no question that all the operations involved in purchasing real estate should comply with the local laws. That’s why it is essential to get familiar with them at the initial stage before making the decision.

Which regulations do you need to check?

-

Country and state laws (if applicable).

If you don’t familiarize yourself with all these legalities, the state government might dispute your ownership in the future.

-

Tax regulations.

For instance, if a foreigner wants to invest in real estate in Texas, they need to pay 15% of the sales price if it exceeds $300,000 and in case the buyer intends to live there.

-

Eligibility.

In some countries, it can be difficult for a foreigner to purchase certain property types. For instance, in Poland, you need to get a permit from the Minister of Internal Affairs if you want to buy a piece of land and build a house. To obtain this permit, you need to be an active taxpayer in the country for several years.

One more point you can’t dismiss is the political situation in the country or region where you’re interested in buying real estate. For instance, if there is geopolitical risk, it may incur the loss of property.

2. Choose an Appropriate Payment Method

You might think that there is only one possible option to send money to purchase property – bank transfers. In reality, you have many more solutions than you think.

Here are some other payment methods to consider:

-

Cash.

If you choose this option, there is a chance that you will close the deal quicker. Also, when paying by cash, you can bargain the price down a bit. Of course, you need to be at the property’s location when making the cash transfer, which is not convenient for everyone, especially considering the worldwide pandemic.

-

Lenders.

These people understand the market very well and can offer you a deal with lucrative interest rates and at a better price. However, there is a high risk of fraud. Besides, some lenders will not work with you if you don’t have proof of sponsorship, citizenship or if your income is unstable.

-

Direct loans from developers.

You can invest in a property at the stage of development. In some cases, this option is more profitable as it can have lower interest rates, which is excellent news if you want to buy property of a bigger size, such as an apartment block or a piece of land.

Also, think about the down payment in advance. Usually, it shouldn’t be higher than 20%, but if you’re applying for a mortgage overseas, you may have to pay more.

3. Get in Touch with Certified Real Estate Brokers

It may seem more than doable to find a suitable property for purchase by yourself, but when it comes to buying real estate in another country, you may become a fraud victim. To avoid that, the only reasonable solution is to hire a certified real estate broker.

Here, it is important to pay attention to the certifications, which should include some of the following:

- ABR (Accredited Buyer’s Representative)

- ALC (Accredited Land Consultant)

- CIPS (Certified International Property Speciality)

- CRB (Certified Real Estate Brokerage Manager)

You should also ask the broker about their experience and portfolio, which should preferably specialize in selling properties to foreign buyers. If they don’t have a portfolio, ask for references – you need proof that this person is qualified.

Another critical point is the language barrier. We already mentioned that you need to get familiar with the laws and regulations of the country where you want to buy real estate. However, it will be hard to do if you don’t know the language. So, if you’re going to buy property in China, your real estate broker should be fluent in Chinese and English to assist with all the questions related to the purchase.

The last crucial thing to consider is the commission rate, which can fluctuate between 2.5% and 6%. In some areas, where real estate is more expensive, the commissions may be higher. So, if you’re going to hire a real estate broker, include their fees in your budget.

Over to You

As you can see, the whole process of investing in real estate overseas is a bit complicated but definitely not impossible. You just need some time to prepare for this important decision.

First of all, learn everything about the laws of the country where you have found the property that interests you. It will help you avoid bans, extra permits and will inform you of all the procedures in general.

Next, think about the payment method suitable for you and the seller. It can be cash, bank transfers, lenders, and developer loans.

Finally

You can simplify the whole process by hiring a real estate broker. They will handle everything involved in the purchase process. Want to learn more about buying a property? Check out our blog!

We hope you enjoyed this blog on How to Invest in Real Estate Overseas. For additional tips, be sure to check out our post 5 Steps to Wholesale Real Estate

Have Experience in the Moving Industry? Want an Additional Income Stream? Work With All Around Moving!

All Around Moving Services Company, Inc., can help you move and also help you profit. If you are interested in applying your skills in the moving industry, check out our program to earn extra income. Click here to learn more.