Relocating is a major life event that often involves selling your current home. Whether you’re moving for a new job, seeking a change of scenery, or downsizing, the process can be both exciting and daunting. The traditional route involves selling your home on the open market, which can be time-consuming and unpredictable. However, there’s an alternative strategy that might be advantageous: the 721 exchange.

The Traditional Path: Selling Before Moving

When planning to move, selling your home is likely one of the first things on your mind. The traditional selling process involves several steps, from deciding on a listing price to staging your home for potential buyers. Timing is crucial; you’ll want to coordinate the sale to avoid a gap between selling your current home and moving into your new one. This can be a delicate balancing act, fraught with stress and uncertainty.

Factors such as market conditions, the location of your property, and the time of year can all impact how quickly your home sells and the price you can secure. Additionally, you’ll need to consider the costs associated with selling, including repairs, upgrades, real estate agent commissions, and closing costs. These expenses can significantly reduce the net proceeds from the sale.

The Alternative: A 721 Exchange

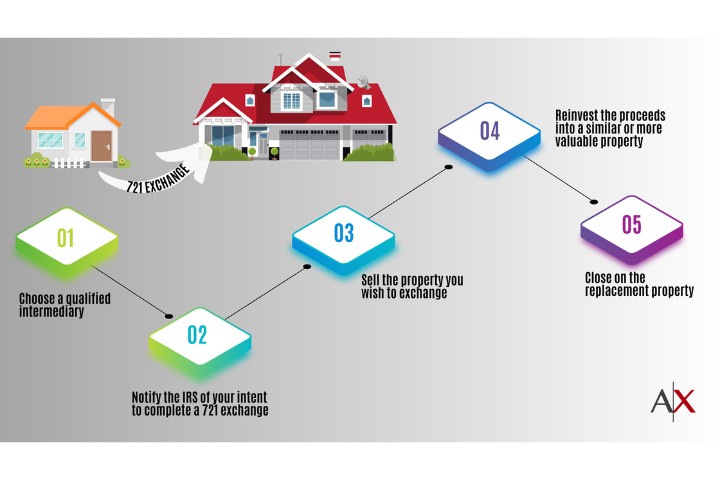

For those seeking a less conventional path, a 721 exchange presents a compelling option. A 721 exchange, part of the broader realm of real estate investment strategies, allows property owners to transition into a different type of investment while deferring capital gains taxes. This can be particularly appealing for homeowners looking to sell their primary residence and invest in real estate indirectly, such as through a Real Estate Investment Trust (REIT).

By opting for a 721 exchange, you can potentially convert the equity from your sold property into a diversified real estate portfolio, offering a blend of stability and growth without the hassles of direct property management. It’s a strategy that not only supports your immediate need to move but also aligns with long-term investment goals. For a deeper understanding of how a 721 exchange works and its benefits, consider exploring the 721 exchange rules.

Considerations Before Choosing a 721 Exchange

Before leaping into a 721 exchange, it’s crucial to weigh several factors. First, understand the rules and requirements of participating in such an exchange. It’s not a one-size-fits-all solution, and specific criteria must be met to benefit from the tax deferral. Additionally, consider your long-term investment objectives and how they align with the nature of the investment acquired through the exchange.

Financial planning plays a pivotal role in this decision. Consulting with a financial advisor who has expertise in real estate investments and tax strategies can provide clarity and guidance. They can help you navigate the complexities of a 721 exchange and determine if it suits your unique circumstances and financial goals.

Preparing for a 721 Exchange

Embarking on a 721 exchange begins with thorough preparation and a clear understanding of the process. The first step involves identifying a suitable investment vehicle, typically a REIT (Real Estate Investment Trust), that participates in 721 exchanges. It’s crucial to conduct due diligence on potential REITs to ensure they align with your investment goals and risk tolerance.

Consultation with a financial advisor and a tax professional who have expertise in real estate transactions and tax law is indispensable. They can offer tailored advice based on your financial situation, helping you navigate the complexities of the exchange and ensuring compliance with all legal and tax requirements.

Finding the Right Investment Opportunity

A key component of a successful 721 exchange is selecting the right investment opportunity. This decision should be guided by your long-term investment goals, whether it’s generating steady income, capital appreciation, or a combination of both. The diversity of REITs available allows you to choose investments that match your risk tolerance and financial objectives.

Consider REITs that invest in property types or sectors you understand and believe in. For example, if you’re optimistic about the future of commercial real estate, look for REITs specializing in office buildings or retail spaces. Alternatively, if you prefer a more stable investment, residential REITs may offer the consistency you’re looking for.

Understanding the Tax Implications

One of the most appealing aspects of a 721 exchange is the ability to defer capital gains taxes on the sale of your property. However, it’s important to understand the specific tax implications and requirements to ensure that the exchange is conducted correctly and the benefits are fully realized.

The deferment of taxes is not indefinite; it’s contingent upon the continued investment in the REIT. The taxes may eventually be due upon the sale of the REIT shares, depending on the structure of the investment and future legislation. Your tax advisor can provide detailed guidance on how a 721 exchange will affect your tax situation and help you plan accordingly.

Pros and Cons of a 721 Exchange

Pros:

- Tax Deferral: The primary benefit of a 721 exchange is the deferral of capital gains taxes, which can enhance your investment’s growth potential by allowing the full use of your proceeds.

- Diversification: By investing in a REIT, you gain exposure to a diversified portfolio of real estate, reducing the risk associated with owning a single property.

- Professional Management: REITs are managed by professionals, relieving you from the burdens of direct property management.

Cons:

- Complexity: The process can be complex and requires careful planning and adherence to regulations.

- Liquidity: While REIT shares are generally more liquid than direct real estate investments, there may be restrictions or penalties for early withdrawal.

- Market Risk: Like any investment, there’s a risk that the value of the REIT could decrease based on market conditions.

Making the Decision

Deciding whether a 721 exchange is right for you involves a careful evaluation of your personal and financial situation, your investment goals, and your comfort level with the complexities of this strategy. Engaging with professionals who can guide you through the process and offer personalized advice is crucial.

Integrating a 721 Exchange into Your Financial Plan

A 721 exchange shouldn’t be viewed in isolation but as part of your comprehensive financial plan. This strategy can play a significant role in your investment portfolio, offering diversification and potentially enhancing returns through tax deferral. When considering a 721 exchange, evaluate how it aligns with your investment goals, risk tolerance, and time horizon.

For many, the appeal of a 721 exchange lies in its ability to convert a tangible asset into a diversified real estate investment without the immediate tax liability. This move can significantly impact your financial flexibility and growth potential, especially if you’re in a high tax bracket or expect to be in a lower one in the future.

Long-Term Benefits of a 721 Exchange

Enhanced Growth Potential

By deferring capital gains tax, you’re effectively investing more capital into your new REIT investment than you would have post-tax, allowing for greater growth potential over time. This compounding effect can significantly impact your portfolio’s value, especially in a growing real estate market.

Income Generation

Many REITs provide regular income distributions, which can be an attractive feature for investors seeking steady cash flow. This can be particularly beneficial if you’re moving towards retirement and looking for reliable income sources.

Estate Planning Advantages

A 721 exchange can also offer estate planning benefits. REIT investments can be more straightforward to manage and distribute among heirs than physical properties. Furthermore, the stepped-up basis rules may apply upon the investor’s death, potentially providing tax advantages for heirs.

Navigating Challenges and Risks

While the benefits of a 721 exchange are compelling, it’s crucial to navigate the associated challenges and risks carefully. Market volatility, regulatory changes, and the performance of the chosen REIT are all factors that can impact the success of your investment. Regular reviews of your investment strategy with your financial advisor can help you adjust your approach as needed to stay aligned with your goals.

Final Thoughts: Is a 721 Exchange Right for You?

Deciding to pursue a 721 exchange as you sell your home and relocate involves careful consideration of many factors. It’s a decision that hinges not only on the immediate benefits of tax deferral and investment diversification but also on your long-term financial planning and goals.

If you’re contemplating a move and looking for ways to optimize your financial situation, a 721 exchange might offer a pathway to both immediate and long-term benefits. However, the importance of professional guidance cannot be overstated. Working with a team of advisors who understand your financial picture and the nuances of real estate investment can ensure that your move and your investment strategy are both steps toward your financial wellbeing.

With careful planning, a 721 exchange can be a strategic component of your financial landscape, providing benefits that extend well beyond the immediate transition period of selling your home and moving. Whether you’re seeking to enhance your investment portfolio, generate income, or plan for the future, exploring the possibilities of a 721 exchange is a move worth considering.

We hope you found this blog post on Selling Your Home When Moving: Is a 721 Exchange Right for You? useful. Be sure to check out our post on The Real Estate Home Buying Process for more great tips!

Have Experience in the Moving Industry? Want an Additional Income Stream? Work With All Around Moving!

If you are interested in applying your skills in the moving industry, check out our program to earn extra income. Partner with us and we’ll help you make money. Click here to learn more.